How Marketing Budgets and Strategies Are Being Impacted by COVID-19

For marketers, few things are more valuable than context. Understanding how your brand fits into the specific context of your audience, your industry, and any given situation holds the key to success.

That’s a key reason why our jobs are so difficult right now. We have no parallel context to fall back on when it comes to the pandemic. Modern society has never faced a global disruption matching the magnitude of the COVID-19 outbreak. While we can draw from precedent when it comes to marketing during a recession, there is no playbook for navigating the unique challenges presented by this crisis.

And over the past several weeks, the pervasiveness and realities of systemic racism are front and center — reminding us we all have a shared responsibility to create an inclusive and more equitable future. These are the multiple layers of context that we are all grappling with right now as we think about how to leverage marketing strategies and use our brand voices, and it has likely never been as important or more complex than it is right now.

Where we can find context is by learning what’s happening around us, in the moment. We may not be able to benchmark against what past marketers have done, but we can take stock of what current marketers are doing and how their audiences are responding.

How is Coronavirus Impacting Marketing Budgets and Strategies?

To help you gain an understanding of where your peers stand, LinkedIn teamed up with Vision Critical in the first week of May to survey 450 marketers on how the pandemic is impacting them, and how they’re responding. The questionnaire addressed topics like budget cuts, tactical shuffles, and focal realignments. See the infographic outlining the marketers' responses.

While many of the findings were more or less expected, we do see a broader theme playing out at a high level. For the marketers we polled, during the COVID-19 crisis, factors forcing strategic shifts are posing greater difficulty than those impacting execution. In other words, it might be harder to take a step back and rethink what we're doing than to just keep doing it. But it is valuable to do so and can ultimately allow us to move forward with greater confidence.

With this in mind, let's explore some specific trends around this theme. Below, we share the insights and takeaways that stood out most in the results.

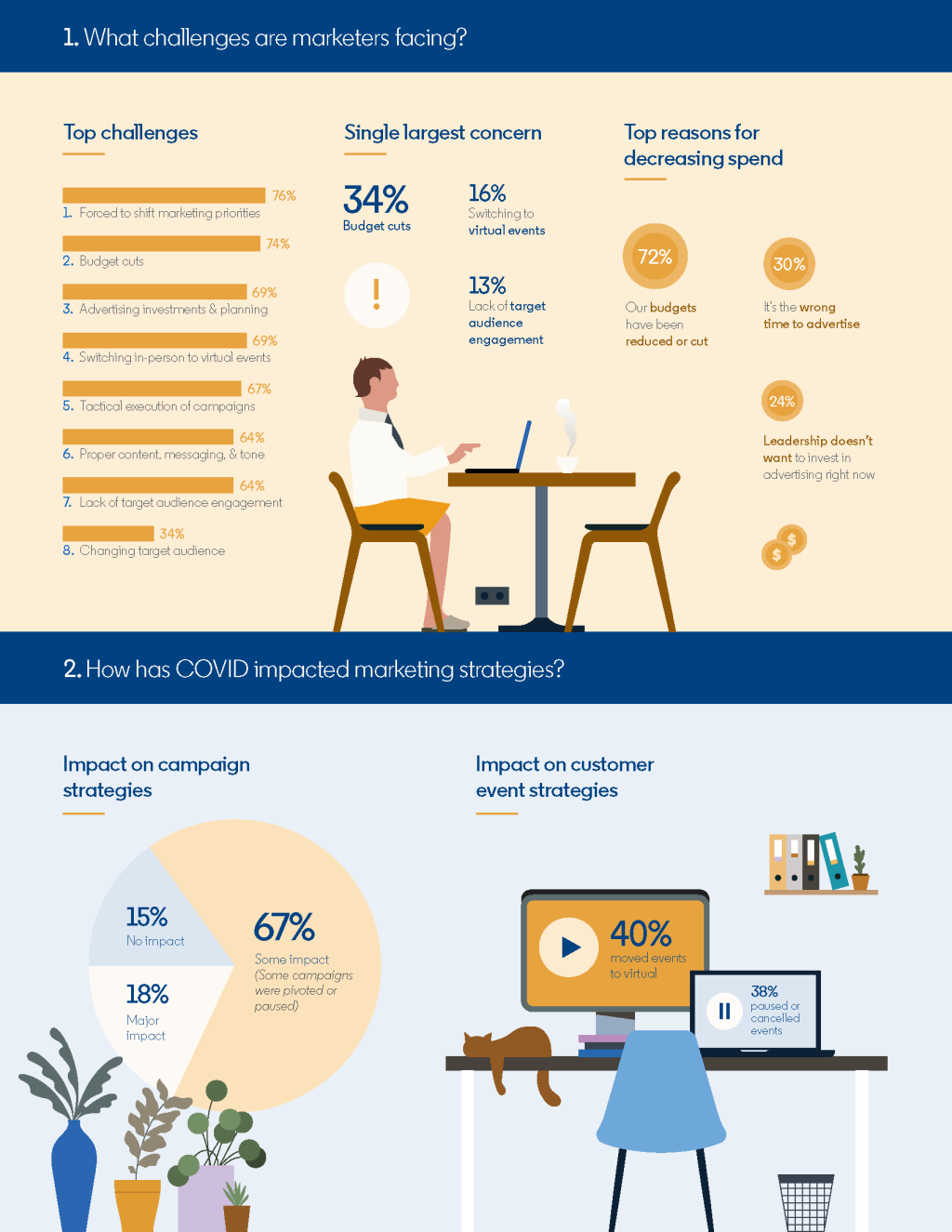

Budget cuts are the top concern and biggest challenge for marketers

No surprise here. In the survey, 42% of respondents cited budget cuts as a “significant challenge,” more than any other answer (74% said cuts were presenting a challenge at some level). The next-highest responses were switching in-person events to virtual events (34%) and being forced to shift marketing priorities (31%). Similarly, 34% of marketers named budget cuts their biggest concern over the next three months, followed by switching to virtual events (16%) and lack of engagement from their target audience (13%).

A more surprising finding was that — while diminished engagement is a concern — marketers aren’t too focused right now on rethinking the people they’re trying to reach; 66% said that changing their target audience was not a challenge, with only 1% identifying it as a top concern.

Agencies (52%) and Performance Marketers (45%) are feeling the impact of budget cuts most.

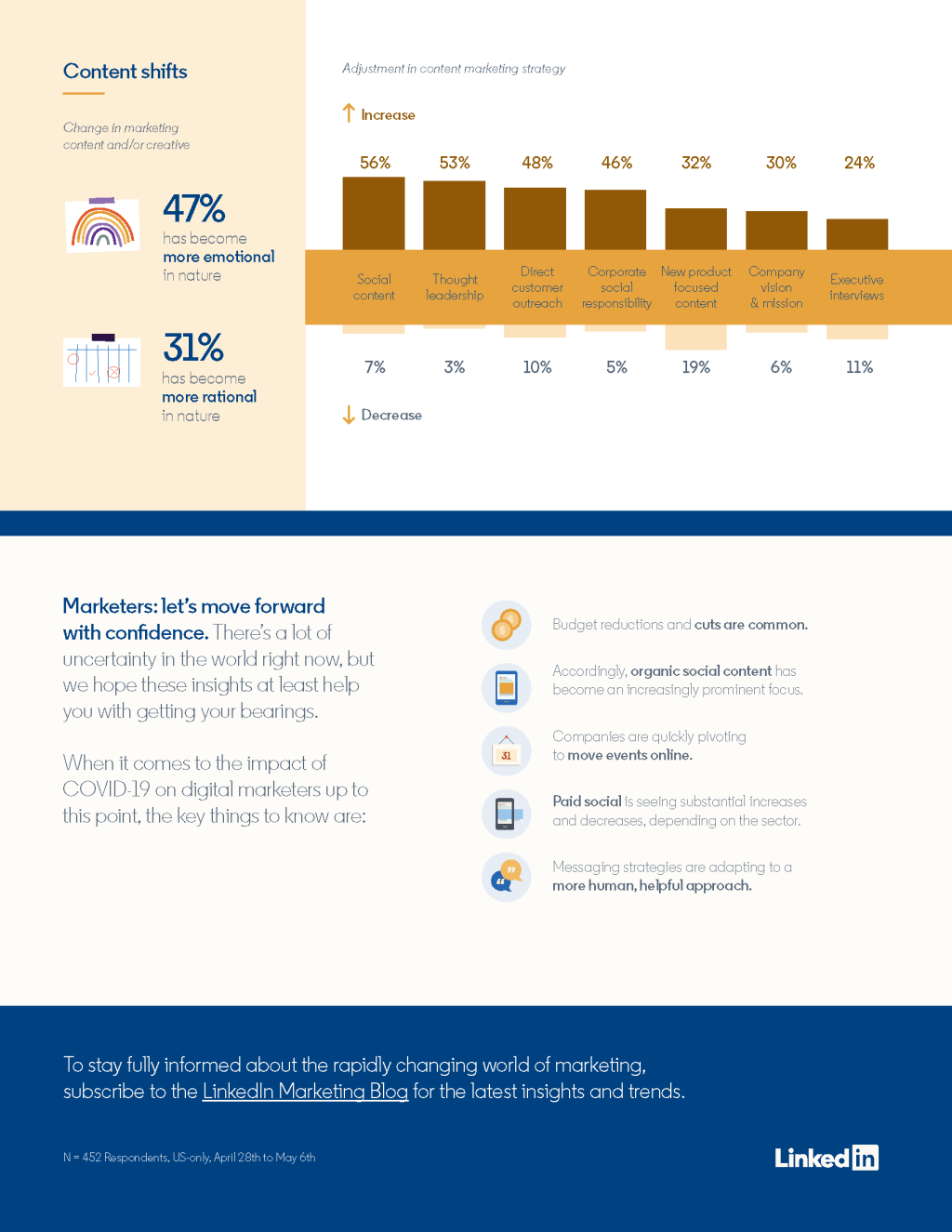

Messaging approaches are shifting

With only one-fifth of marketers saying they haven’t changed their creative approach in response to COVID-19, 47% say they’ve increased focus on emotional and human-centric content. Considerably fewer (31%) say they are emphasizing logical, product-centered content.

Only 8% of marketers have paused external marketing/creative output during the crisis.

Social content and thought leadership on the rise

More than half of marketers say they’re increasing the prevalence of social (55%) and thought leadership (53%) in their content marketing strategies. Also high on this list were direct customer outreach (48%) and corporate social responsibility (46%). Product-focused content has seen the largest decrease at 19%.

The bottom line: marketers get it. This isn’t the time to talk about ourselves or our solutions. It’s a time to connect, converse, and be there for a human audience searching for information and sources they can trust.

B2C companies (57%) are more likely than B2B companies (42%) to be increasing Corporate Social Responsibility investment.

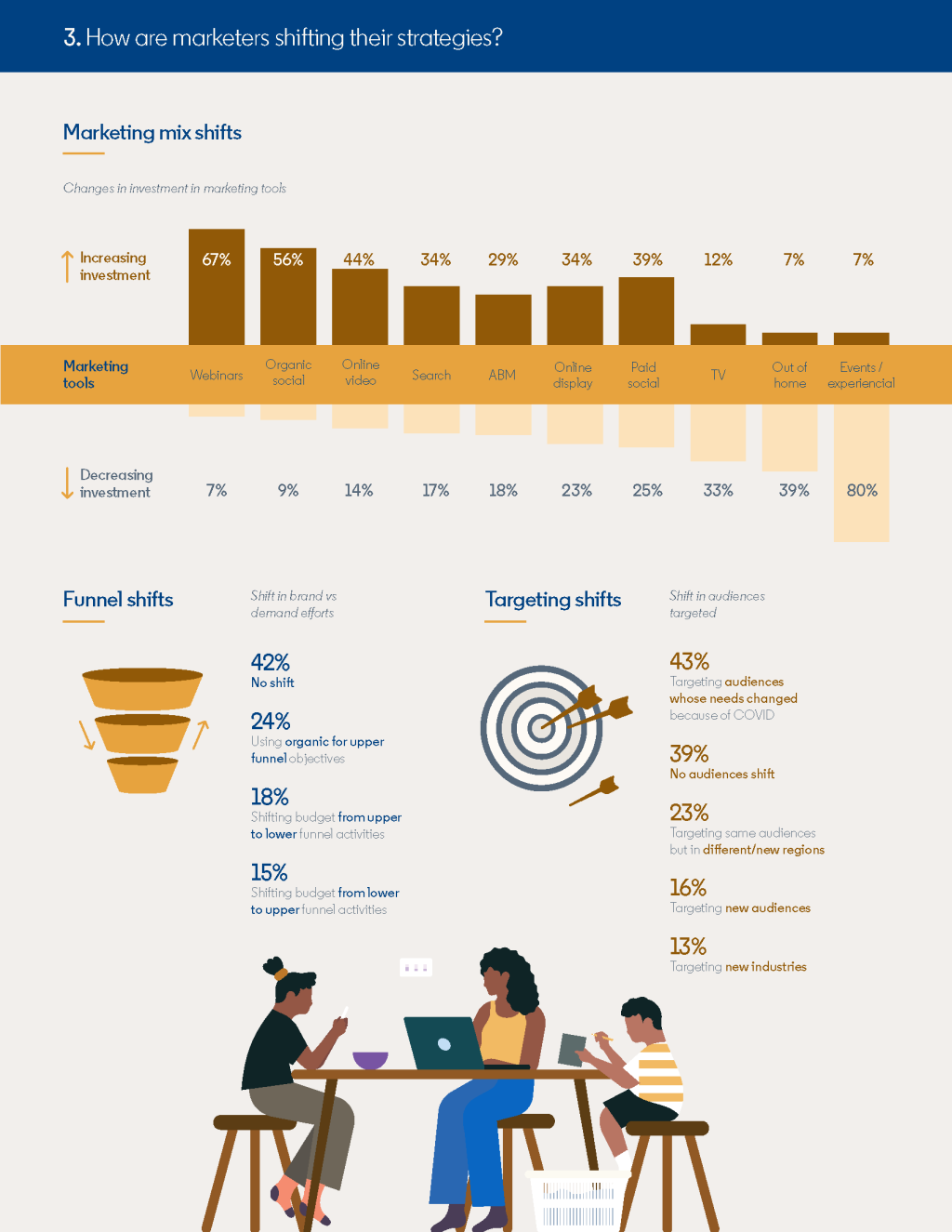

Webinars are up, events are down

We asked marketers how their tactical mixes are changing in the midst of this crisis. Here’s where we are seeing the biggest increases:

- Webinars (67%)

- Organic social (56%)

- Online video (44%)

Conversely, these tactics and channels are seeing the biggest decreases:

- Events/experiential (80%)

- Out of home (39%)

- TV (33%)

Interestingly, paid social has seen both a substantial increase (39%) and decrease (25%), with only 36% of marketers holding steady. The contrast plays out, in part, between two cohorts: Performance (35%) are more likely than Brand Marketers (20%) to be decreasing their paid social investments, which makes sense given that Performance Marketers reported being hit harder by budget cuts.

72% of marketers cite budget reductions as a top reason for pulling back digital marketing investments.

Experiences are moving online

While in-person events might be off the table for the time being, most brands aren’t simply dropping the tactic. When asked how COVID-19 has affected customer event strategies, 40% of marketers said they’re planning to move events online, if they haven’t already. Another 13% are considering the possibility of virtual formats. Meanwhile, 38% say they are pausing or canceling all upcoming events.

Move Forward with Context and Confidence

There’s a lot of uncertainty and distress in the world right now, but we hope these insights can help you get your bearings. When it comes to the impact of coronavirus on digital marketers up to this point, the key things to know are:

- Budget reductions and cuts are common

- Accordingly, organic social content has become an increasingly prominent focus

- Companies are quickly pivoting to move events online

- Paid social is seeing substantial increases and decreases, depending on the sector

- Messaging strategies are adapting to a more human, helpful approach

The key findings in the survey are outlined in the infographic below.