This Week’s Big Deal: Tailoring Your Sales Approach for 2 Key Variables

In sales, and in life, there are no one-size-fits-all solutions. This is where “best practices” tend to miss the mark — they might be helpful as general guidelines, but they’re never ideal for every single situation.

Salespeople are often advised to lead with insights and ask questions when engaging with decision makers. Generally speaking, this is how we cultivate a value-driven, customer-centric approach. But that off-the-rack approach misses some crucial nuance.

An intriguing new piece from Harvard Business Review zeroes in on the importance of tailoring your approach to specific customer types, especially in B2B sales.

The Essential Variables of Who and When in B2B Sales

The writeup, from Frank Cespedes and Tracy DeCicco, carried an eye-catching headline: Why “Tell Them Something They Don’t Know” Is Bad Advice in B2B Sales.

“Over the years, we’ve observed many salespeople who successfully make developing and delivering meaningful insights a core part of their approach,” the authors explain. “Their experience and our research indicate that, at a minimum, you need to do more than ‘tell people something they don’t know.’ That approach can lead you to develop irrelevant factoids. Instead, we suggest crafting a strategy based on whom you’re talking to and where you are in the sales cycle.”

It sounds obvious, but it’s easy to get off the rails. Especially if you’re scheduling a high volume of meetings/conversations and don’t feel like you have time to meticulously customize each one. This often leads to a cookie-cutter messaging that — while rightfully shifting focus to buyer rather than seller — might still fail to resonate.

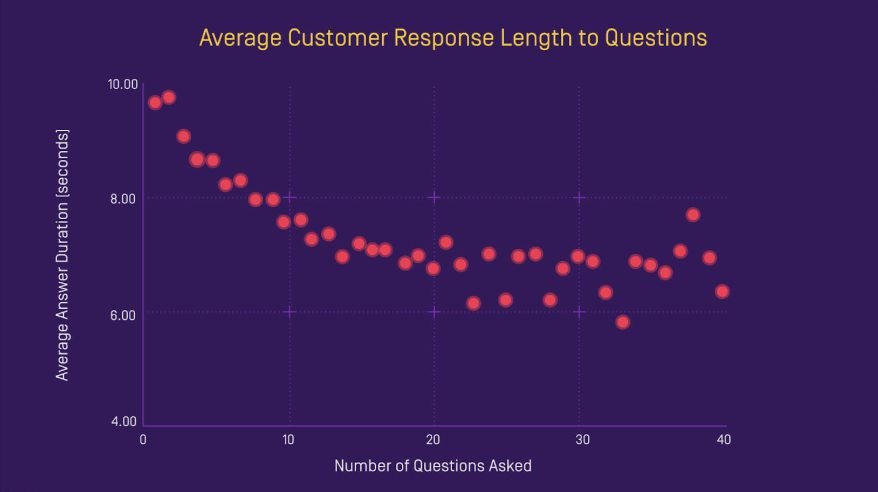

“Choosing the wrong approach can have negative consequences,” the article asserts, citing a study from Gong.io on selling to the C-suite which showed that asking too many questions of senior buyers can actually be counterproductive to closing sales. Gong’s analysis indicates that executives can experience “discovery fatigue” when fielding too many questions on a call, and their responses become increasingly brief as a result.

(Source)

As one Chief Revenue Officer quoted in the post said, “Your job isn’t to ask me what’s keeping me up at night. It’s to tell me what should be.”

But this doesn’t mean sales reps should completely shy away from an exploratory approach. Gong’s research actually shows that asking more questions can be more conducive to closing deals — when you’re talking to lower-level managers (or gatekeepers).

With this in mind, the process for a successful and repeatable strategy might look like this:

Get a layout of the account you’re pursuing, separating the mid-level purchase influencers from the top-level execs and directors. Much of this insight can be gleaned through LinkedIn and Sales Navigator.

Engage with the lower-level players first, asking questions and gaining a specific idea of how your solution fits with their business and needs.

Then, approach the more senior decision makers with a consultative, to-the-point pitch rooted in the knowledge you’ve gained in steps one and two.

This isn’t quite as intensive as tailoring your outreach specifically to every single person you’re engaging, but data suggests it can go a long way toward improving results. When we talk about personalizing at scale, these are the kinds of practical steps that make it happen. For more guidance on optimizing your approach based on who you’re talking to, check out our post from last week on getting closer to the buying committee, featuring the perspectives of various actual committee members on how they like to work with salespeople.

In their piece for HBR, Cespedes and DeCicco add that the “when” is critical in addition to the “who” when sparking up sales conversations. Reps need to be cognizant of where a prospective customer is in the buying cycle.

In the earlier stages, enlightening industry insights and — especially — social proof can help build urgency and push past the status-quo that tends to bog down many deals (“60% of all buying ‘decisions’ are to postpone a decision,” notes one salesperson in HBR’s article).

Last month we reviewed research illuminating opportunities to engage buyers earlier and accelerate the sales cycle; social proof is a great way to combat inertia. When decision makers can see authentic examples of other similar companies benefiting from your solution, it turns your framing from theoretical to empirical. It also can tap into that sense of FOMO dread (i.e., “Our competitors are gaining this advantage and we aren’t”).

As the finish line draws closer, you’ll want to reinforce the value and fit, but also build confidence in the ease and smoothness of implementing your solution. By now, top decision makers are grappling with the realities of organizational change and friction. “At this stage, they want to know how you’ll follow through at the implementation stage,” according to HBR. “In fact, a classic study found that across industries the top criterion senior executives use to judge the salespeople they meet is the salesperson’s ability to marshal the selling firm’s resources.”

Small Tweaks to Your Sales Approach Pay Big Dividends

None of the recommendations above represent major departures from a modern selling methodology. Understanding your prospects and delivering valuable, personalized insights are table stakes today.

Adding some nuance and tailoring your messages based on seniority and buying cycle are minor changes that can make a major difference. Keep these tips in mind as you continue to optimize your approach.

Subscribe to the LinkedIn Sales Blog and never miss out on the latest big deal in B2B sales.

Topics: Sales trends

Related articles